Whether for a mortgage, a car loan, or to secure credit approval, verification of income (VOI) and employment (VOE) are necessary steps for financial institutions and fintech firms.

In this Insights explainer, we unpack the state of traditional verification methods, identify the golden source of truth for VOI and VOE data verification, and highlight a few benefits of linking user-permissioned verification data with payroll connectivity.

The problems with traditional verification methods

Unfortunately, for your customers, VOI and VOE are often cumbersome and time-consuming. They involve manual labor to collect documents from disparate sources, like HR, payroll systems, bank accounts and other places where data for income and employment reside.

With fabricated paystubs, false income statements and augmented wages on applications commonplace, the process is no easier for financial institutions. Prosper, an online lender, states that about 11 percent of its loan applications contain false or insufficient employment or income information. This poses a risk of extending credit to unqualified buyers and exposes a vulnerable loophole in the lending process.

Add the gig economy to the mix, such as Uber and Lyft drivers—whose deposits arrive in varying intervals, amounts, and live in multiple payroll systems—and suddenly the intricacies of verifying income take on a new level of complexity.

VOI and VOE data verification straight from the source

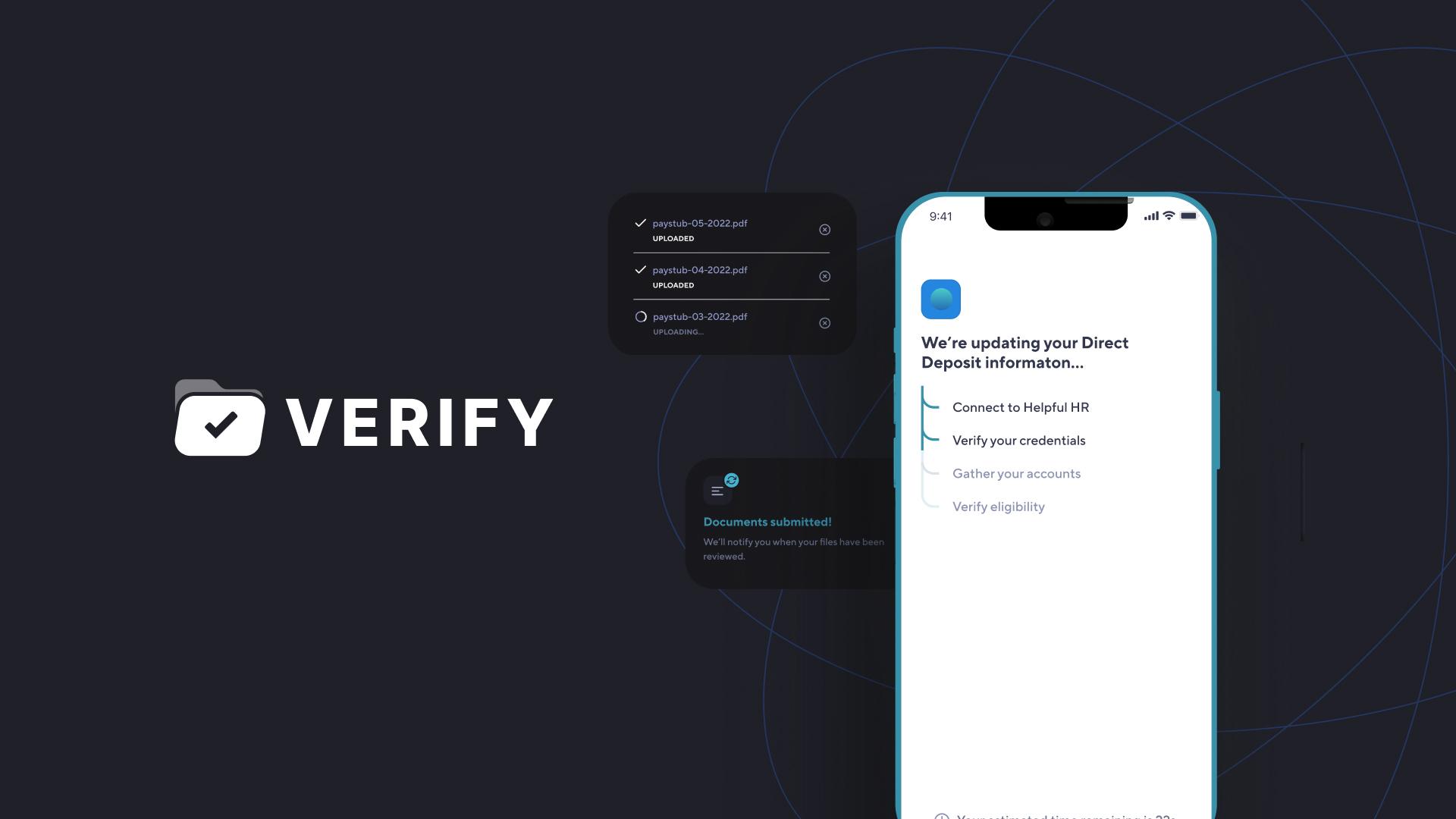

With Atomic’s Verify solution, you can shift income and employment verifications from reactive retrieval. Payroll information is collected after the fact in the form of pay stubs or bank statements. It then goes to proactive collection, where it’s actively accessed from payroll systems in real-time.

Additionally, with Verify, the data hidden in paychecks can be analyzed and enriched to capture a holistic, automated and accurate snapshot of an employee’s income and employment history.

By surfacing the most important data points from the source of truth itself–payroll–Verify mitigates fraud and subsequent risks to lenders, removes the burden of proof and guesswork from underwriters, and prevents falsified information from carrying weight in lending decisions.

User-permissioned access to financial data in payroll

Payroll connectivity is at the root of our API and forms the foundation of Verify’s functionality.

Representing a powerhouse of rich consumer data, payroll information speaks loudest and most accurately about consumers’ earning and borrowing capacities.

Atomic’s API empowers customers with simple and convenient payroll connectivity through Verify. Customers can log in to their payroll provider directly from their financial institution’s website or application using the credentials they establish with their payroll provider. This saves them from having to navigate away from their financial institution’s website to gain access to payroll data, streamlining everything on one screen.

Once credentials are validated and the customer is connected to their payroll provider, Verify lifts data from the payroll system through an industry-secure connection. Data collected can include:

-

-

- Total annual income

- Status of employment

- Pay cycle

- Hours worked

- Tax and pre-tax deductions

- Any other information the payroll provider collects

-

Atomic’s Verify removes friction by automating manual processes, saving time and resources for financial institutions during income and employment verification.

A win-win for financial institutions and end-consumers

Our Verify solution provides consumer-permissioned access to financial data for income (VOI) and employment (VOE) verifications quickly, conveniently and in real-time. Plus, security is inherent in our API. We go through regular external security audits and use only strong TLS protocols to ensure encrypted transmission of data.

Furthermore, with Verify’s consumer-permissioned access, consumers can grant financial institutions a view into the data layered behind their paychecks. This provides an accurate snapshot or ongoing view of their borrowing capacity.

By leveraging payroll data to make lending decisions, financial institutions can reduce fraud, improve privacy, and gain lending confidence. They can also simultaneously open avenues to lower-cost financial services and improving financial outcomes for consumers.

Access to direct-source payroll data in real-time streamlines verification for critical processes, like loan underwriting and earned wage access. It accelerates qualification and approval processes and helps to accurately assess the creditworthiness of even “thin file” customers.

The Atomic difference for financial institutions and lenders

Solutions such as Verify move the industry closer to its goal of advancing credit inclusion and financial outcomes for consumers. With Verify, you can:

-

-

- Reduce fraud

- Lend with greater confidence

- Augment your loan pool by extending financial products at lower interest rates

- Reduce the costs of underwriting

- Increase customer retention

- Compete with customers’ digital expectations

- Improve data privacy practices

- Expand access to credit for traditionally marginalized consumers, improving financial outcomes for them

-

By validating income and employment status in an automated, reliable and consumer-permissioned way, Verify places financial power back in the hands of consumers, and simultaneously works to the benefit of financial institutions.

Want to grow your active user base and increase customer conversion? Reach out to team Atomic for a demo to learn how our market-leading coverage scales to over 2.5 million monthly consumers that access payroll connectivity through their financial applications.